Caduceus Software Systems Corp (OTCMKTS:CSOC) frames itself as a Wyoming-based holding company focused on M&A involving businesses already at commercial stage operations.

Right now, according to recent company communications as well as trading mechanics data, this could actually be a very interesting story.

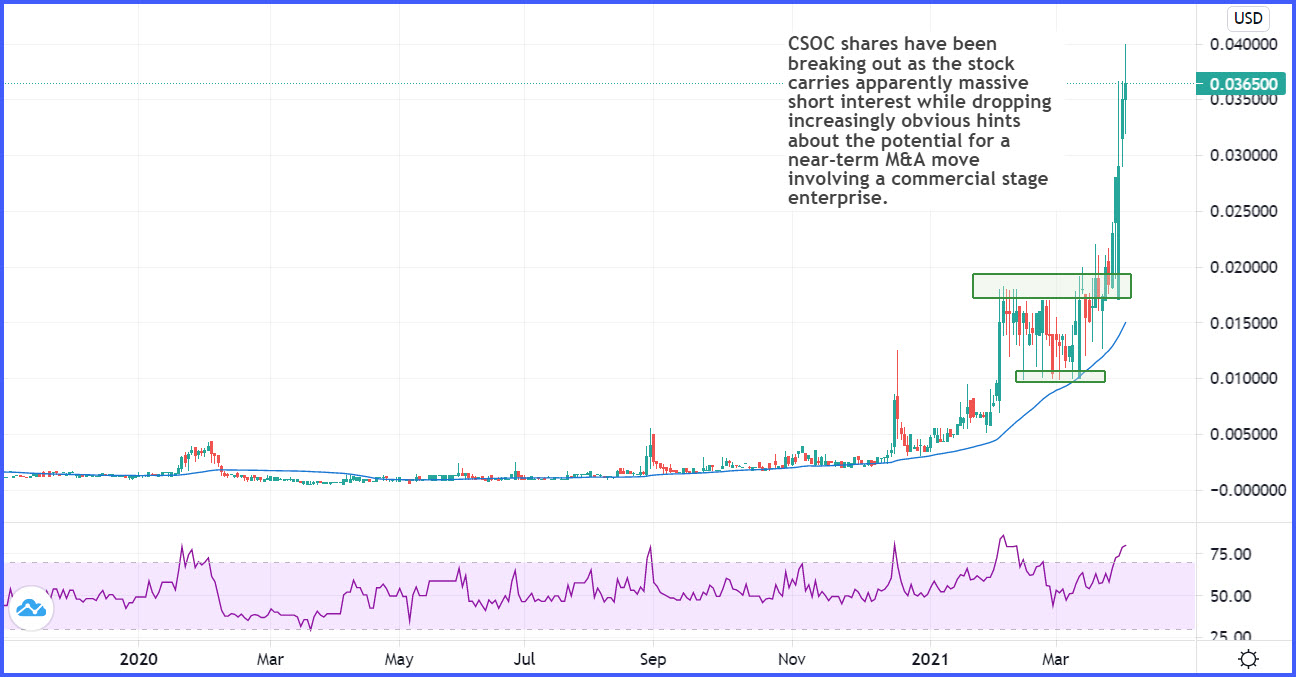

The basic gist of that story is that this is a heavily shorted name that might be on the verge of some game-changing revelations based on hints dropped by the company in its recent corporate update release as well as its social media posts.

There’s No Ceiling

In the first case, OTCshortreport.com shows CSOC shares to be overwhelmingly popular among active bears, with over 15 million shares of short-side transactions over the past few days making up almost 75% of all transactions in the stock over that period.

The fact that CSOC has been so heavily shorted is not immaterial to analyzing the future potential path for the stock because it implies an increased potential for a short squeeze dynamic to take place on further strength.

Short squeezes happen for the simple reason that risk is unlimited to those on the short side – the lowest a stock can go is zero, but the highest it can go is infinity. Once you sell what isn’t yours, you have to buy it back to square up.

When lots of people crowd into a stock on the short side, and then that stock starts to rally, the need for everyone to “cover” those short positions at the same time can lead to a lack of availability of shares to buy, which is the essence of a squeeze. It’s like price-gouging during a shortage of some raw good.

Last year, during the pandemic’s early stages, we saw a shortage in toilet paper and some small stores started to hold some toilet paper back and then raise the price sharply when it went on the shelves… and people paid up because they needed it.

The same thing happens ever hurricane season in Florida with batteries and bottled water.

But, when it happens with shares in a stock due to overcrowding of short interest, the result can be huge gains for investors on the other side of the trade. This was painfully obvious in GameStop Corp (NYSE:GME), AMC Entertainment Holdings Inc (NYSE:AMC), and Fubotv Inc (NYSE:FUBO) earlier this year.

However, to set the panic off and running, one generally needs to see some sort of catalyst come into the picture.

Dropping Hints

In the case of Caduceus Software Systems Corp (OTCMKTS:CSOC), the catalyst is clear.

Remember: this is a holding company focused on acquiring commercial stage businesses. If you’re short this stock, you must be assuming that acquisition PR isn’t about to drop. However, shares of CSOC have started to move higher in recent days, and it might have something to do with the company’s recent hints about the potential for just such a PR to drop sooner rather than later.

For example, in the company’s most recent press release, it announced a new CEO (Alex Chen). This is often part of an acquisition process or reverse merger. We don’t know if that’s the case here, but it is a common step. In addition, Mr. Chen is a former investment banker – guess what investment bankers do (hint: it rhymes with Lemonade, but without the “d” sound at the end).

There was also this line in the press release: “The Company will be sharing further details with shareholders and prospective investors in the coming weeks about its acquisition plans.”

Not years. Not months. Weeks.

Finally, if you take a look at the company’s twitter feed, you will find two recent tweets that don’t really leave a whole lot to the imagination:

“$CSOC Needs room to issue restricted shares for the upcoming merger. More details will be available soon.”

“$CSOC is currently in discussion with multiple candidates for a merger acquisition. One of the key element we are looking for is a pandemic and recession proof business, in a market that can thrive especially in hard times. Hence giving investors peace of mind.”

In other words, either 1) the company has decided, under brand new executive management after investing in getting back to current, to completely torch its credibility, or 2) some M&A news is going to drop in coming weeks.

Given the massive short interest that appears to be threaded deep in the CSOC tape right now, the potential for some form of squeeze is palpable.