We continue to find interesting opportunities in this market, and our newest pick is another perfect example of potential growth that has not yet been discovered by the market.

Carsmartt is a Silicon Valley startup trading on the OTC markets that is breaking into the rideshare space. You have heard of Uber, and perhaps Lyft. Carsmartt is growing its user base in the same space, and the early user adoption numbers look strong. The company is already offering service in the US and areas of Europe and recently announced it is gaining momentum in South America.

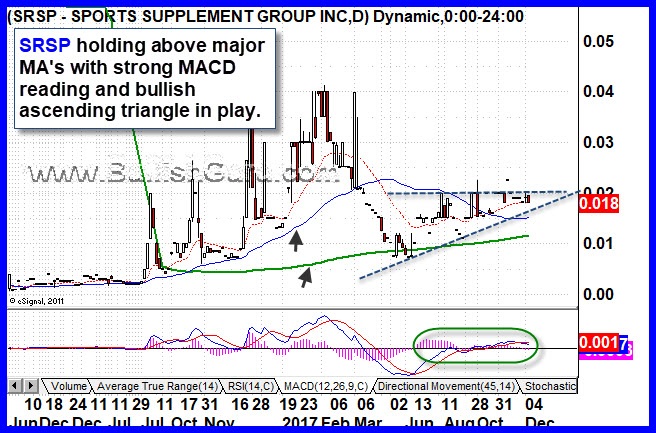

The stock has a limited float and a chart that has been trending higher since early last year, and now trades above its major moving averages with what technicians call a “bullish ascending triangle” recently coming together on the chart.

Symbol: SRSP

Company: Carsmartt

Quote: http://finance.yahoo.com/q?s=SRSP

Latest News: http://finance.yahoo.com/q/h?s=SRSP+Headlines

Company Website: http://www.carsmartt.com

Carsmartt, f/k/a Sports Supplement Group Inc. (OTCMKTS: SRSP) bills itself as “a start-up company of the revolutionary APP. CARSMARTT.COM a ride-sharing concept located in Palo Alto CA. (Silicon Valley), at CarSmartt we aim to make long distance traveling safer and more affordable while connecting with people along the way. CarSmartt members can choose to share a ride or ship a package with the option of applying for insurance coverage. All CarSmartt drivers are subject to a background check to reassure the safety of passengers. CarSmartt is currently now active in the USA and ITALY. However, our company will soon continue to expand to Europe and Canada.”

As noted above, this is a new and possibly emerging play in the explosive rideshare space. Uber was the real first mover in the space and has paved over many obstacles, laying an educational path in its wake, and helping younger companies like Carsmartt utilize market-tested strategies for issues like driver background checking, passenger safety, vehicle standards, and app adoption and feature design.

According to a recent Statista research piece, revenue in the Ride Sharing segment will amount to roughly $11.8 billion in the US in 2017. But significant growth lies ahead, with the number of users expected to explode to 72.4 million by 2022. The average revenue per user (ARPU) in the Ride Sharing segment amounts to $260.90 in 2017. If we carry that math forward, the market is set to expand to nearly $19 billion over the next five years – growth of nearly 40%.

With a market volume of $22.5 billion in 2017, most revenue is actually generated in China, suggesting there is room for the company to continue its global expansion trend and bump growth rates.

The company has also recently moved into the $300 billion parcel shipping market with its recent deal to insure parcel delivery in its ride share vehicle force.

Recent Catalysts

Perhaps the most interesting recent announcement out of the company just hit in recent days: According to Roy Capasso, the President of Carsmartt, “The Company has now started a marketing campaign for the Colombia rideshare community. Latin America is one of the fastest growing market in the world and Carsmartt is committed to grow its users and give a better service for city to city destinations with background check for people and parcels shipping.”

One of the reasons the company has chosen to focus on the Columbian market is because the safety of Trains and Busses is not guaranteed, and the mass transportation system in Bogota is enormously crowded and chaotic. That context is a tailwind for rideshare demand. And high unemployment creates easy access to high-quality driver candidates.

The company also recently announced that on November 7, 2017, the United States Patent and Trademark Office approved the company’s name and logo CASRSMARTT for CLASS 9: Computer software for coordinating transportation services, namely, software for electronic message alerts featuring leads, optimal matches, and scheduling movement of motorized vehicles. This adds substantial value to the enterprise in the form of formal registered intellectual property.

That announcement was preceded by a landmark announcement in late October stating four key themes:

First, that the company has completed an agreement with U-PIC, a shipping insurance company to provide CarSmartt users the ability to ship parcels with the CarSmartt ridesharing program with insurance covering up to $1,000 per parcel, per user choice.

Second, that the company entered into an agreement with Firewall Soluciones to provide marketing and advertising for CarSmartt in Mexico.

Third, that the company released its Facebook page for the Italian market, with its in-house marketing team already expanding efforts there.

And Fourth, that the company had begun development of a social networking environment for users.

Technical Analysis:

The chart tells the story of a stock with the promise that has not yet been fully discovered by the market. Shares are showing technical positives in the form of an established upward trend, action holding above major moving averages, a strong recent signal from the MACD indicator, and the presence of a clear bullish ascending triangle defining the past three months of action.

However, we have yet to see the type of clear breakout movement that one might associate with an emerging new player in a high-growth industry such as rideshare. The key for shares will be a break above the top of the recent triangle breakout pattern around the $0.02/share level.

The float is limited to just 42 million shares, suggesting a lack of overwhelming entrenched overhead supply on any subsequent jump in prices.

Key Points:

- SRSP is witnessing fast user growth as an emerging Silicon Valley startup in the explosive $12B rideshare space.

- SRSP has recently moved into the $300 billion parcel shipping market.

- SRSP has begun international expansion, establishing new campaigns in Mexico, Italy, and Columbia.

- SRSP shares have been trending higher, above key moving averages, demonstrating an underlying supportive framework from insiders.

- SRSP just recorded a MACD Bullish reversal, suggesting a technical confirmation of its recent upward bias.

- SRSP shares have been forming a key technical pattern knows as a “bullish ascending triangle” which chartists see as a precursor to an eventual potential upward breakout.

We don’t often see Silicon Valley startups available to investors on the public markets. This is an interesting example of something that looks highly promising from each angle of analysis but has yet to attract a crowd of speculators. That suggests shrewd investors may have a ground floor chance of involvement in this interesting company.