After a gap of few months, Mike Statler, the fictional co-editor of Stock Tip, first highlighted outfit statement given back in the month of June that their next huge stock pick is coming. Finally, he revealed the name of the stock which is none other than Safer Shot, Inc. (OTCMKTS:SAFSD). Stock Tips is undoubtedly one of the most prominent promotional outfits around and its stock picks are often keenly awaited. However, this time, when people heard the new name, they were a bit underwhelmed.

The details

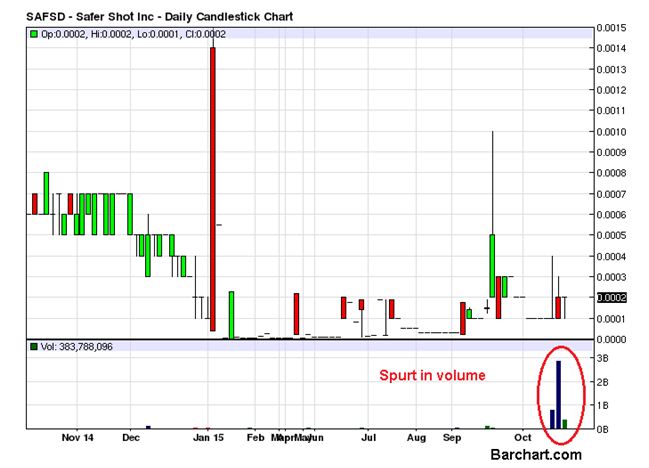

The stock pick Safer Shot appears like a normal Stock Tips promotional target at first glance. Even the emails are no different and the longer than required video is also there, and so is the massive compensation, which at close to $2 million, looks stretched as Statler talks about fortune and wealth. Yet, when chart of Safer Shot is studied, the stock appears firmly fix to the $0.0001 mark.

According to Statler videos and emails, being anchored to the bottom suggests that Safer Shot has limited downside and that even a small momentum in the right direction will offer investors with a lucrative opportunity for a big profit. He added that unlike the rest of the firms, SAFSD is a solid entity.

The performance

Although the demonstration videos and business plan looks promising enough, Safer Short has yet to monetize on its products. As per the latest financial report, the company reported current assets of $443 in cash and current liabilities of $110,216. The revenue in quarter came at $20,000 and net loss stood at $9,134. It should be noted that revenue recorded in the quarter didn’t came from selling products, but was a result of “extraordinary gains”. There is no explanation as to what the recorded gains comprised of and how were they generated?

Safer Shot, Inc. (OTCMKTS:SAFSD) was not traded a lot in the last few months but the picture may have changed a bit in the last few sessions. The stock ended the last trading session with a gain of 100% riding on the back of the volume of 383 million, more than double the daily average of 177 million. The volume pattern of the last 3 session may be encouraging, considering the renewed activity but the gain or loss in the price may be ignored at this level. The stock is trading at the lowest possible tick levels and just a single tick represents a gain of 100% or loss of 50% now.