Global Equity International Inc (OTCBB:GEQU) along with its subsidiary unit Global Equity Partners Plc. a specialist consultancy firm with its offices in Dubai and London stated that their client group International FIM SRL has entered into a term sheet worth $7 million, with a US financial institution.

The expert view

Peter Smith, the Chief Executive of GEP, reported that their objective was to permit International FIM SRL to funding of up to $9 million and then help the company with growth plan in the automotive parts manufacturing business. He further said that they are extremely pleased about having got them the first term-sheet as this capital funding will be mutually helpful to both Global Equity and International FIM SRL.

The impact

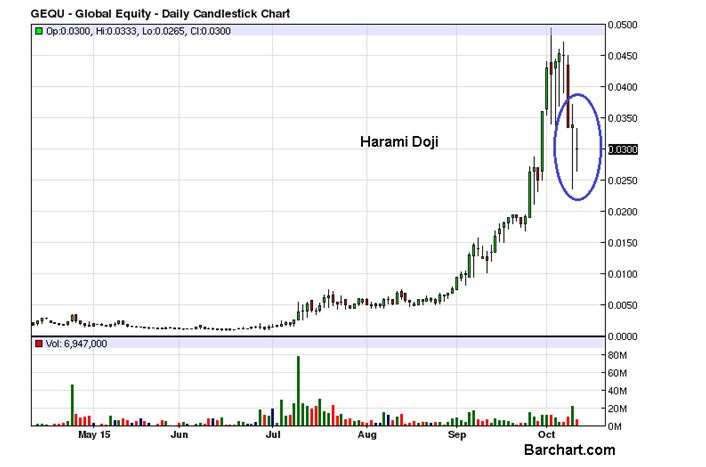

On Monday, the stock price of Global Equity dropped more than 11% to close the trading session at $0.0300. This marks a minor correction as the stock had gained significantly in last four months. Global Equity stock up move in recorded in last few months can largely be attributed to the new agreements and deals, and the up listing of its stock on the OTCQB marketplace. After the decline recorded in yesterday’s trading session, the market cap of GEQU stands at $22.57 million.

The numbers

As per the last quarterly report for the period ending June 30, 2015, the company reported cash of $734, current liabilities of more than $3 million and current assets of $52,490. The net income came at $372,802 and revenue was $1.14 million. No doubt Global Equity posted a positive bottom line, but it should be noted that it was a result of having stock in the private entity Duo World Inc, received in lieu for services.

The concerns

Recently, Global Equity stated that they planned to pay all the convertible debt agreed to in 2014. However, before they can do that, 75 million shares were released as the debt was converted into company’s stock at $0.0005 per share. In addition, more shares were allotted to company’s insiders against debt payment.

Global Equity International Inc (OTCBB:GEQU) showed the first sign of contraction as it finished the lst trading session with a major loss of 11.5%. The volume of the day at 6.9 million was slightly lower than the daily average of 7.8 million, emphasizing the corrective nature of the price action. The previous session was quite long from the daily range perspective and the entire range of yesterday contained inside that, creating an Inside day pattern. This pattern reflects a gradual collapse of volatility and a few more narrow range days this week before the expansion of volatility and price range would not be very surprising.