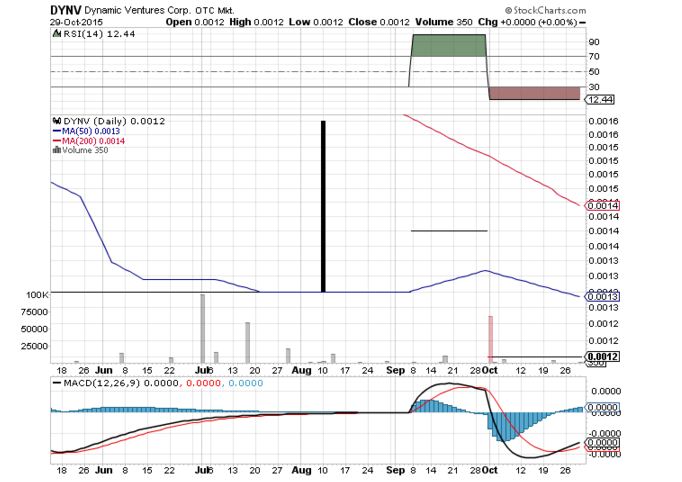

Shares of Dynamic Ventures Corp (OTCMKTS:DYNV) have surged by more than 900% compared to yesterday’s close and a whooping 42o percent from its open today. Currently, DYNV is trading at $0.0068 on a volume of 6.16 million shares. The company filed its quarterly report back in 2012 and since then has not released any PR updating on its financial performance. Below is the chart for DYNV indicating little to no interest from the trading and investing community.

The highlights

Dynamic Ventures entered into a share purchase deal with BBSI in 2012 following which the later became the primary operating entity. For the quarter ended June 30, 2012, the total sales jumped 341% over the comparable quarter in 2011. BBSI recorded revenue of nearly $4 million and gross margin of $260,745 in the reported period.

The revenue of $47,907 from floor art division formed almost 1% of the total revenue while 99% of revenue came from General Contracting segment. Gross margin from floor art division and General Contracting segment came at $9,969 and $250,776, respectively.

Dynamic Ventures recorded a net loss of $513,527 for the quarter ended June 30, 2012 and total expenses amounted to $774,272. There were no costs of sales or revenue for Native American Housing or Engineered Building Systems as there were no projects under construction during the reported period. BDC recorded no cost of sales or sales activity in the quarter.

The details

Native American Housing recorded no activity and Engineered Building Systems failed to commence operations in 2011. However, activity commenced in March, 2011 on the North Dakota project, adding to revenue from General Contracting segment. The start up activity continued in 2Q of 2011 and therefore, revenue came higher in 2Q2012.

In second quarter of 2012, both BDG’s and Floor Art’s focus remained on the homebuilding industry. BDC’s and Floor Art’s decline in sales for the quarter ended June 30, 2012 versus the quarter ended June 30, 2011 can largely be attributed to dismal growth in the homebuilding industry during this time period. Also, there were no new assignment for the Native American housing segment during the quarters ended June 30, 2012 and 2011.