Great Basin Scientific Inc (NASDAQ:GBSN) a molecular diagnostics firm reported that it retained Roth Capital Partners as its financial advisor firm to help in a restructuring of Series C Warrants. These were released as part of the Unit offering that company concluded on March 2, 2015.

The details

Great Basin disclosed that it is preparing to submit a proxy statement and schedule a special shareholder meet to get approval to implement a reverse stock split process and authorize additional common shares in an attempt to fulfill its obligation to provide common shares under the exercise provision of its Series ‘C’ Warrants.

Ryan Ashton, the CEO and President of Great Basin, said that while the Series ‘C’ Warrant exercises have brought company’s stock price under great pressure. Still, they remain on defined course for 2015 objective of obtaining almost 180 clients and four FDA approved products.

The scope

Great Basin is utilizing the capital raised in March 2015 to support its research and development plans and the related activities. The expansion of R&D team will help company to fast-track the process of product commercialization and menu development in 2016. Additionally, the company has increased the size of its sales team in an attempt to accelerate client acquisition in the fourth quarter of 2015 and 1H2016.

Great Basin Scientific can be stated as a molecular diagnostics firm that markets innovative chip-based technologies. It is dedicated to the advancement of simple, yet powerful products and technology that offers rapid multiple-pathogen diagnoses of fatal infectious diseases. The company’s objective is to convert molecular diagnostic testing in a cost-effective and simple process so that every patient can be examined for serious infections, mitigating probability of misdiagnoses and significantly restricting the spread of infectious disease.

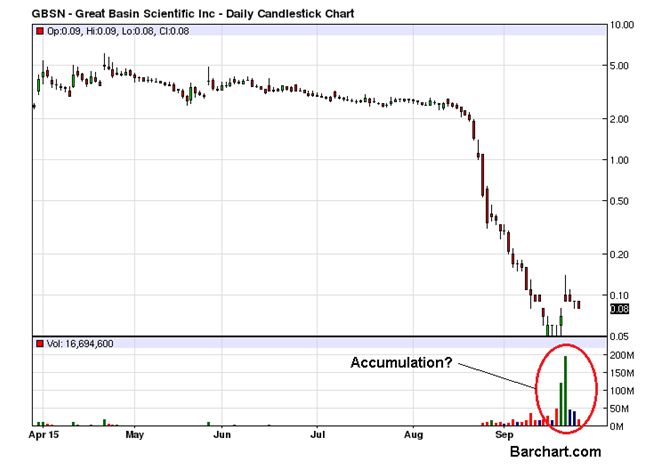

In last trading session, the stock price of Great Basin declined more than 6% to close the week at $0.0834.

Great Basin Scientific Inc (NASDAQ:GBSN) is trading 99% lower from the 52 week high and that is the reason why another red day doesn’t affect the stock in any significant way. On the other hand, the surge in volume seen in the recent few days may be the first sign of some bottom fishing taking place at the lower levels. The stock ended the last trading session with a loss of 11.11% but for this particular day, the volume remained low at 16.6 million, almost half the daily average of 33.6 million, keeping the possibility of another bounce up faintly alive.